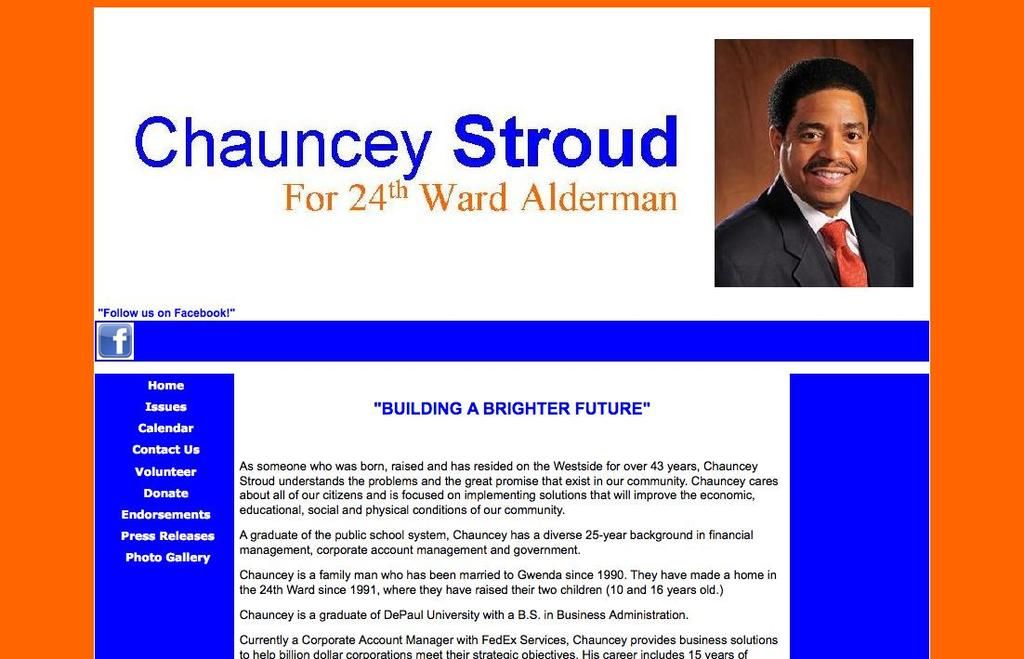

Bitcoin and various altcoins may find recovery in April, indicated by five distinguishing trends.

April's Crypto Showdown: Positive Vibes in the Market

The crypto world's energy is high, simmering with potential recovery signs for Bitcoin and altcoins come second half of April 2025. Let's dive into the key divergence signals that may breathe new life into the crypto game.

Bitcoin's Hidden Strength: A Fight Against the Stream

Remember the strange dance between Bitcoin and the mighty US Dollar? BTC usually moves in the opposite direction to the US Dollar Index (DXY). But in the past few months, they seemed to be swaying together in the same rhythm. The tune has changed in April!

What just happened? A sweeping tariff policy kickstarted a return to the traditional tango between BTC and DXY. If you're curious about what triggered this sudden Tariff-tanic, Joe Consorti, Head of Growth at TheyaBitcoin, thinks he has the answer. He observed that the alarm sounded when the US announced its aggressive tariff regime, and investors have been rushing to the solid rock of Bitcoin as a haven amid global financial uncertainty.

The man predicts, "Bitcoin has been diverging from the US dollar since the US announced its sweeping tariff regime. At a time of global reordering, gold and bitcoin are shining."

Tech Stocks and Bitcoin: A Long-Term Dance of Separation

Tuur Demeester, a Blockstream advisor, made another notable observation. Historically, Bitcoin closely followed the path of the NASDAQ Index representing tech stocks, given their interconnected relationship. But here's the twist: in April 2025, Bitcoin broke free. It started growing independently without following NASDAQ anymore. While some call this separation a conservative call, Demeester sees only bright prospects.

"In 2025, 'Bitcoin divergence' and 'Bitcoin decoupling' are terms destined to dominate headlines," announced Demeester.

Hold on tight as NASDAQ faces rough waves from interest rate issues and slowing growth. Yet Bitcoin just keeps sailing, showing a stunning performance. All signs point to Bitcoin as a standalone asset, escalating beyond the grasp of traditional markets.

Data from CryptoQuant spoke another language regarding investors' behavior. When it comes to Bitcoin accumulation, long-term holders (LTH) are back in the game, while short-term holders (STH) are busy cashing out. The chasm between LTH and STH movements just might signal signs of a forthcoming price rebound.

"When conviction meets capitulation, it heralds the earliest hints of a re-accumulation phase," believes an analyst at CryptoQuant.

Altcoins on the Rise?

Divergence signals also popped up for the rugged altcoin scene, hinting at short-term good fortune.

Jamie Coutts, Chief Crypto Analyst at Realvision, spotted a pattern using the "365-day new lows" indicator. The number of altcoins plunging to new 365-day lows dropped significantly in April. And that's usually a happening before recovery in altcoin market caps.

"Divergence means downside momentum has been exhausted," Coutts said.

Simply stated, when fewer altcoins reach their lowest ebb, it suggests fewer panic-sales. The weakening negative market sentiment coupled with rising prices indicates altcoins may soon be on the rise – or even kick off an 'altcoin season', where altcoins steal the shine from Bitcoin.

Another noteworthy divergence comes from the RSI (Relative Strength Index) on the Bitcoin Dominance chart (BTC.D), highlighted by analyst Merlijn The Trader. This chart reflects Bitcoin's part in the total crypto market allocation.

This anomaly suggests that BTC.D might soon experience a powerful correction. If that day comes, expect investors to start piling into altcoins again.

The altcoin market cap (TOTAL3) rebounded by 20% in April, from $660 billion to over $800 billion. The discussed divergence signals hint that this recovery could continue.

Now you know the top divergence signals at play in the April crypto market. Keep your eyes peeled and your portfolio armed. The crypto game is tinged with excitement, and it's up to you to seize the moment.

Disclaimer

In the name of transparency, BeInCrypto wishes to assure readers that this article aims to deliver accurate, timely information. Yet, it is crucial to cross-verify facts and seek professional advice before making investment decisions based on this data. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been modified as per the Trust Project guidelines.

- By mid-April 2025, Bitcoin and altcoins display promising signs of recovery, igniting optimism in the crypto world.

- A change in the rhythm between Bitcoin and the US Dollar index (DXY) hints at a return to traditional trading patterns, triggered by the US's aggressive tariff policy.

- Joe Consorti, Head of Growth at TheyaBitcoin, suggests that the US's tariff policy announcement sparked a rush towards Bitcoin as a safe haven amid global financial uncertainty.

- Tuur Demeester, a Blockstream advisor, notes that Bitcoin has broken free from its historical relationship with tech stocks, signifying its emergence as a standalone asset.

- Data from CryptoQuant indicates that long-term Bitcoin holders are accumulating, while short-term holders are selling, potentially signaling a price rebound.

- Jamie Coutts, Chief Crypto Analyst at Realvision, suggests that the reduction in the number of altcoins reaching new 365-day lows could herald an 'altcoin season', where altcoins outshine Bitcoin.

- Merlijn The Trader highlights an anomaly in the Relative Strength Index (RSI) on the Bitcoin Dominance chart, which may signal a upcoming powerful correction, leading investors to pile into altcoins again.

![Detailed depiction of the controversial figure known as [person_name], portrayed in this image. Bitcoin and other cryptocurrencies may see a bullish rebound by April 2025, according to indicators, as global economic conditions and investor attitudes undergo changes.](https://gizmoarena.top/en/img/2025/04/26/1157706/jpeg/4-3/1200/75/image-description.webp)