Corley's Board Position at LSEG Appears Questionable, as Assessed by Mark Kleinman

*Whoa there, finance folks! Let's chat about the gossip in the City. The hot topic at the moment is Dame Elizabeth Corley, Sky News' City Editor's weekly column hero and the chair at Schroders. Last week, tabloids were abuzz about her taking on a new role – joining the board of London Stock Exchange Group (LSEG), and let me tell you, this surely isn't your typical corporate move.

People in the know say Dame Elizabeth's appointment might just set her up as a strong contender for the succession to LSEG's current chair, Don Robert. But it seems Robert ain't going anywhere soon, so one has to wonder about the timing. It won't be long before succession chatter starts swirling around LSEG, given that CEO David Schwimmer's been on the job since 2018. Normally, a new chair would be appointed first to lead the recruitment process for a new CEO, but it seems unlikely Schwimmer wants to stick around for another decade or so. LSEG hasn't said a peep about leadership succession, though.

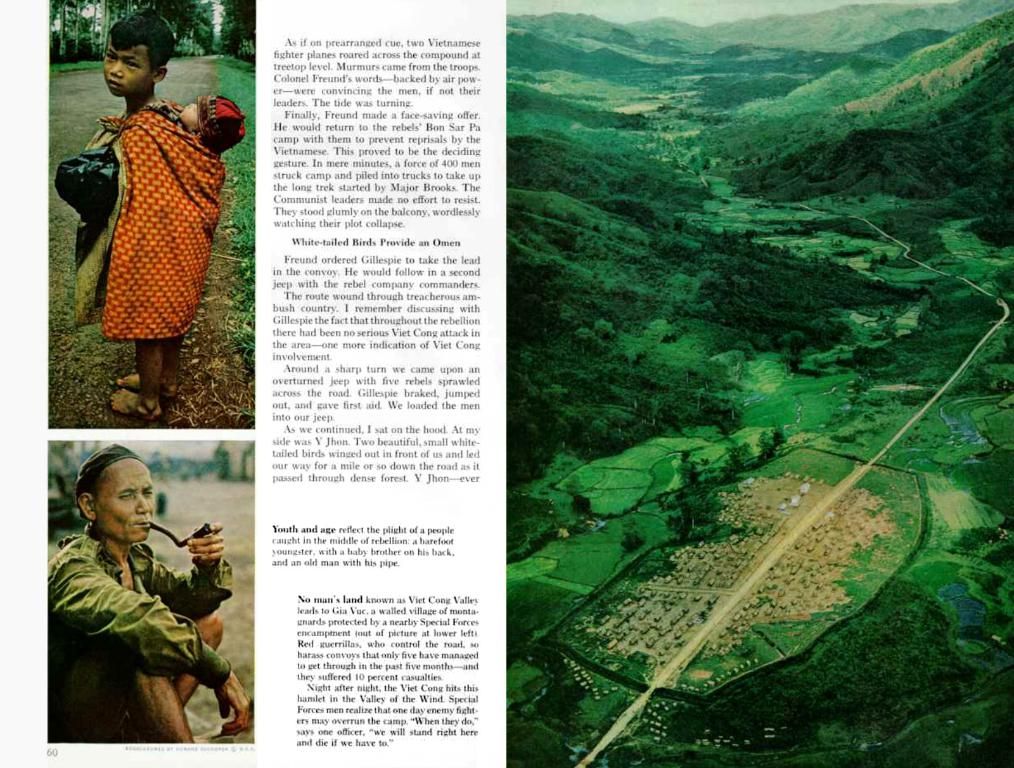

Moving on to the elephant in the room: conflicts of interest. Schroders is listed on the LSE, so there are obvious commercial relationships between the two companies. As a shareholder in LSEG, Schroders has a say in governance matters, and pay protests from its leading investors reared their heads again at the recent LSEG annual meeting. Dame Elizabeth wouldn't have any part in decisions regarding companies Schroders is invested in. But hey, appearances matter, and this double-dipping gig could sour people's tastes, especially given Schroders' recent exit from the LSE-led Capital Markets Industry Taskforce – details I spilled the beans on yesterday.

You might say her fellow Schroders directors must've noticed something amiss, but they sure didn't turn a hair, seeming to sign off on Dame Elizabeth's move. Schroders is smack in the middle of a turnaround under new CEO Richard Oldfield, so it's surprising that this task alone might not keep her occupied enough.

Now let's talk about Simon Peckham and his scheme at Rosebank Industries. After trying to buy Electrical Components International from Cerberus Capital Management and being thwarted by tariff concerns, Peckham is back for more. Rosebank confirmed a re-engagement in talks with Cerberus to strike a deal – a move that makes sense considering the duo's due diligence was almost complete. Peckham always seems to be pulling out the same playbook, going for industrial assets with potential for operational improvement. The risk of tariff uncertainty persists, but if the advisers are okay with the team's track record, Rosebank's bet on ECI should be one that won't leave a sour taste.

Lastly, Starling Bank hasn't had the best year with profits down and Covid loan guarantee provisions up. Add to that the £29m fine from the Financial Conduct Authority for poor financial crime controls, and it's safe to say Starling couldn't catch a break. But there's a silver lining. The bank's efforts to expand its technology arm, Engine, into a significant revenue and earnings driver seem to be paying off. Sources say Starling is inching closer to unveiling its biggest deal yet, with Canada's Scotiabank. The contract could spit out revenues of £50m (though it's unclear whether that's annual or a one-time figure), making it a substantial agreement for Starling's Engine arm, which has smaller deals in the works with Salt Bank in Romania and AMP in Australia.*

Did You Know?- Dual board membership can present potential conflicts of interest and lead to perceptions of favoritism.- LSEG and Schroders have a direct business relationship since Schroders is listed on the LSE.- Dame Elizabeth Corley's dual roles at Schroders and LSEG may raise questions about the independence of the LSEG board and the effectiveness of internal oversight.- Formal processes, such as protocols and disclosures, are in place to manage potential conflicts, though their effectiveness remains under question.- Starling's efforts to grow its technology arm, Engine, could become significant revenue and earnings drivers for the group.

- With Dame Elizabeth Corley taking up a dual role at Schroders and the London Stock Exchange Group (LSEG), discussions about potential conflicts of interest are heating up in the world of finance and business, particularly due to their direct business relationship.

- The rollercoaster ride for Starling Bank has seen its profits decline and face hefty fines, but there's a glimmer of hope with its technology arm, Engine, edging closer to a major deal with Canada's Scotiabank. This could potentially transform Engine into a significant revenue and earnings driver for Starling.

- Technology plays a pivotal role in modern banking and investing, as seen in Starling's push to grow its technology arm, and Dame Elizabeth Corley's expertise in both technology and finance could be crucial if she indeed becomes a strong contender for the succession to LSEG's current chair.