Ethereum Braces for Pectra Update and FOMC Decision: Notable Events Ahead for the Digital Asset Giant

Ethereum (ETH) heads towards a pivotal juncture, as two influential factors collide on Wednesday, May 7.

Crypto enthusiasts are amidst a heated debate – will this "perfect storm" trigger a breakout or escalate recent price wobbles, given the blurred macro signals and dwindling faith in Ethereum's pitch?

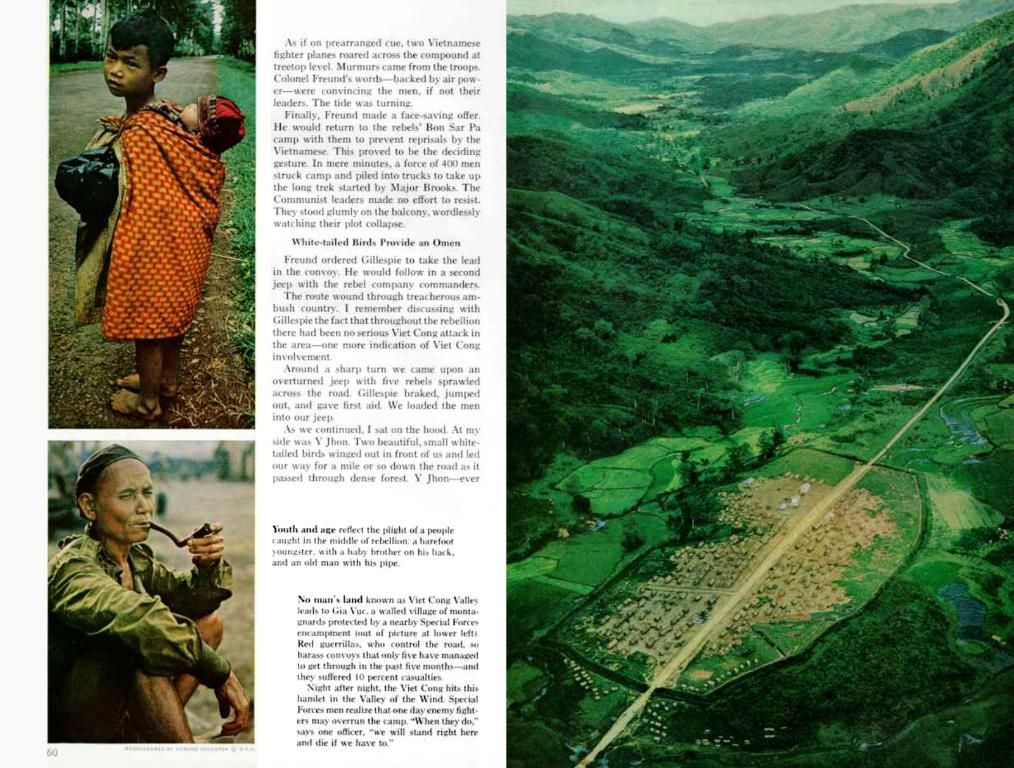

Ethereum's Turbulent Crossroads: Pectra Update and FOMC Clash

The long-awaited Ethereum Pectra update is just hours away. This anticipated event promises major enhancements such as EIP-7702 and a tight 2,048 ETH staking limit, boosting Ethereum's user-friendliness and efficiency.

Paired with a potentially dovish Jerome Powell, some predict this week might ignite a robust rally in ETH and altcoins.

"May 7th Ethereum Pectra update. May 7th FOMC. Micro caps already surging. If the Crypto Lords are on our side, we could witness the mother of all breakouts, particularly on altcoins," CryptoSkull tweeted.

Others echoed similar enthusiasm, albeit with a touch of caution, mindful of the crypto market's volatile nature.

"FOMC week and ETH Pectra update? It's high time we keep our eyes wide open. Bullish vibes are fantastic, but let’s not forget the unpredictable nature of the market. The Feds might just throw us a curveball," another user warned.

While others see this collision as a high-stakes dance, they specifically focus on the likelihood of the Ethereum price reacting to these two events converging.

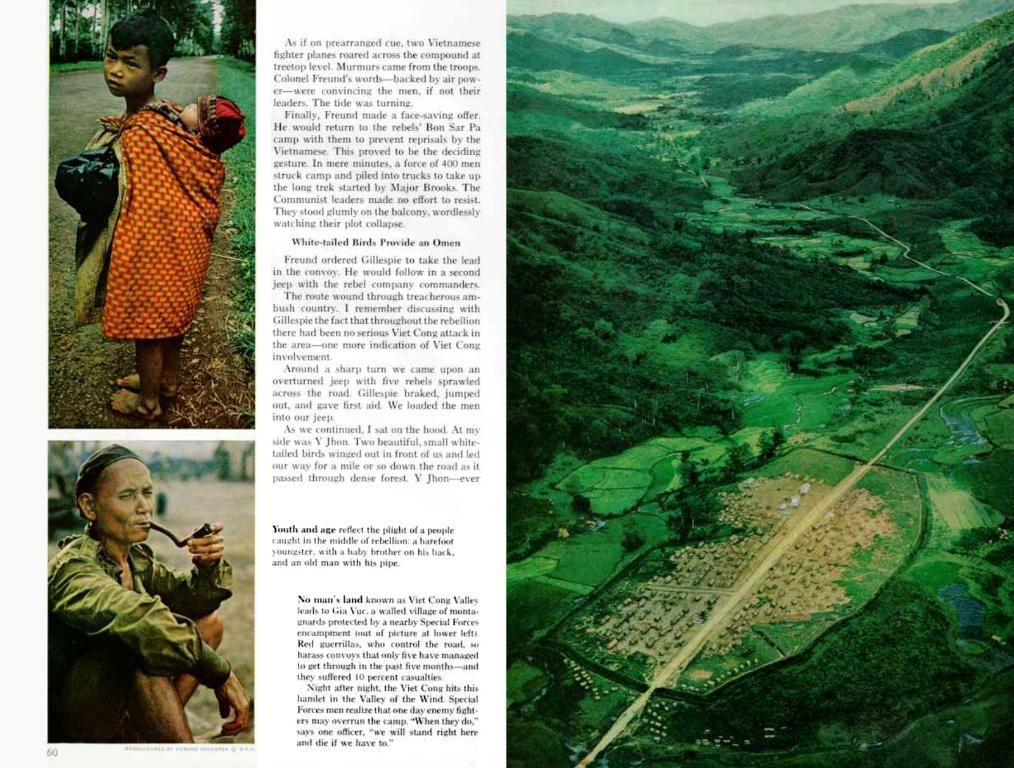

Ethereum Community: Hope, Hype, and Hard-Earned Lessons

That said, not all see the Pectra update as an instant price catalyst. Maria Magenes, VP of Strategy at Hype Partners and ex-marketing chief at Balancer and MakerDAO, tempered expectations.

"Even if I {cheekily} hoped for a price bump, that's not the real idea behind why this is exciting... Network upgrades don't trigger price bumps... These aren't cosmetic changes... They ensure Ethereum stays the most innovative, decentralized, and dependable network ecosystem-wide," she articulated.

Certain users, however, put forth a more nuanced view, calling the Pectra update a legitimate trigger for volatility. Beyond the technical upgrade, Ethereum is also grappling with a broader narrative quandary.

Once the undisputed king of smart contract platforms, Ethereum now faces increased scrutiny over fees, decentralization trade-offs, and developer departures to ecosystems like Solana.

Still, some traders remain bullish. As BeInCrypto noted, Ethereum traders are primed for a breakout, with price patterns signaling mounting pressure.

The May 7 FOMC decision, however, introduces notable uncertainty. While most analysts expect the Fed to leave rates unchanged, traders remain cautious about Powell's tone. A hawkish stance could derail the bull sentiments.

"The risk-off attitude persists as we approach the Fed meeting... Bitcoin accumulation is promising... we expect Ethereum to rebound after Wednesday," analyst Michaël van de Poppe jotted down.

May 7 could shape Ethereum's near-term course, leaving the second-largest crypto by market capitalization in a precarious quandary between protocol development and macroeconomic risks.

On Wednesday, we'll witness whether Pectra triggers a rally or gets drowned in macroeconomic headwinds.

eToro | YouHodler | Wirex | NEXO | Arkham

Disclaimer

BeInCrypto is dedicated to fair, unbiased, and transparent reporting. This article endeavors to provide accurate, timely information. However, readers should independently verify facts and seek advice from a financial expert before making investment decisions based on this content.

In accordance with the Trust Project principles, please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

- The Ethereum Pectra update, scheduled for Wednesday, May 7, brings anticipated enhancements like EIP-7702 and a 2,048 ETH staking limit, boosting Ethereum's efficiency.

- Despite the eagerly anticipated updates, some analysts predict a dovish Jerome Powell during the FOMC meeting this week could ignite a robust rally in ETH and altcoins.

- CryptoSkull tweeted that May 7 could trigger the mother of all breakouts, particularly on altcoins, based on the convergence of the Ethereum Pectra update and the FOMC meeting.

- Another user cautioned ignoring the unpredictable nature of the market, even with bullish vibes, reminding everyone to keep their eyes wide open.

- Some view the convergence of the Ethereum Pectra update and the FOMC meeting as a high-stakes dance, focusing on the likelihood of the Ethereum price reacting to these events.

- While the Pectra update may not be an instant price catalyst for some, like Maria Magenes, VP of Strategy at Hype Partners, it provides exciting enhancements for the Ethereum network.

- A more nuanced view suggests the Pectra update could be a legitimate trigger for volatility, beyond the technical upgrade, given Ethereum's broader narrative quandary.

- Ethereum, once the undisputed king of smart contract platforms, now faces increased scrutiny over fees, decentralization trade-offs, and developer departures to ecosystems like Solana.

- Michael van de Poppe, an analyst, expects Ethereum to rebound after Wednesday's FOMC decision, despite the risk-off attitude persisting as they approach the Fed meeting.

- May 7 places Ethereum, the second-largest crypto by market capitalization, in a precarious position, facing a battle between protocol development and macroeconomic risks.