Mobile service M-KOPA expands financial access in Africa, reporting the sale of 1 million smartphones, transforming them into essential financial tools.

M-KOPA's Smartphone Business: A Fintech Powerhouse in Africa

M-KOPA, a Nairobi-based fintech company, has made waves in the African market with its innovative approach to smartphone sales and financial services. While specific profitability metrics for the smartphone business alone have not been publicly disclosed, the broader company shows signs of a financially viable business model.

In just a year after launch, M-KOPA sold over 1 million branded smartphones, representing more than 20% of all smartphones sold in Kenya during that period. This rapid growth has extended to other African countries, including Uganda, Nigeria, Ghana, and South Africa.

M-KOPA's success is not solely attributed to smartphone sales. The company operates a pay-as-you-go financing model that integrates hardware sales with digital financial products such as microloans, insurance, and health coverage. This strategy enhances customer lifetime value and contributes to the company's overall financial trajectory.

By the end of 2025, M-KOPA is on track to exceed $500 million in annual revenue, growing at a rapid pace with a 65% year-on-year revenue increase in 2024 and a 42% CAGR from 2020 to 2023. Beyond smartphone sales, the company has disbursed over $2 billion in digital credit to about 7 million customers across multiple African countries.

M-KOPA's smartphones come integrated with the Smart Money Platform, offering users access to micro-loans, health coverage, device insurance, and other digital financial tools. This approach aims to address the gap in access to credit, insurance, and essential digital tools in Africa.

The company's strategy to fortify its ecosystem by controlling the hardware strengthens its grip on the customer. M-KOPA assembles its smartphones locally at its Nairobi facility, which is now Africa's highest-output smartphone assembly plant. Since launching in 2023, the factory has generated over 400 jobs and earned ISO 9001 certification.

M-KOPA's goal is to transform smartphones into both communication devices and portable financial hubs. The company's fusion of hardware and credit could emerge as a blueprint for others in Africa's fintech landscape. Africa's digital economy is pivoting from heavy spending to measurable impact, and M-KOPA's approach could be influential in this transition.

However, uncertainties surrounding M-KOPA's profitability and device ownership status remain to be addressed. The company has not shared profitability metrics for its smartphone business or clarified how many of the 1 million devices have been fully paid off.

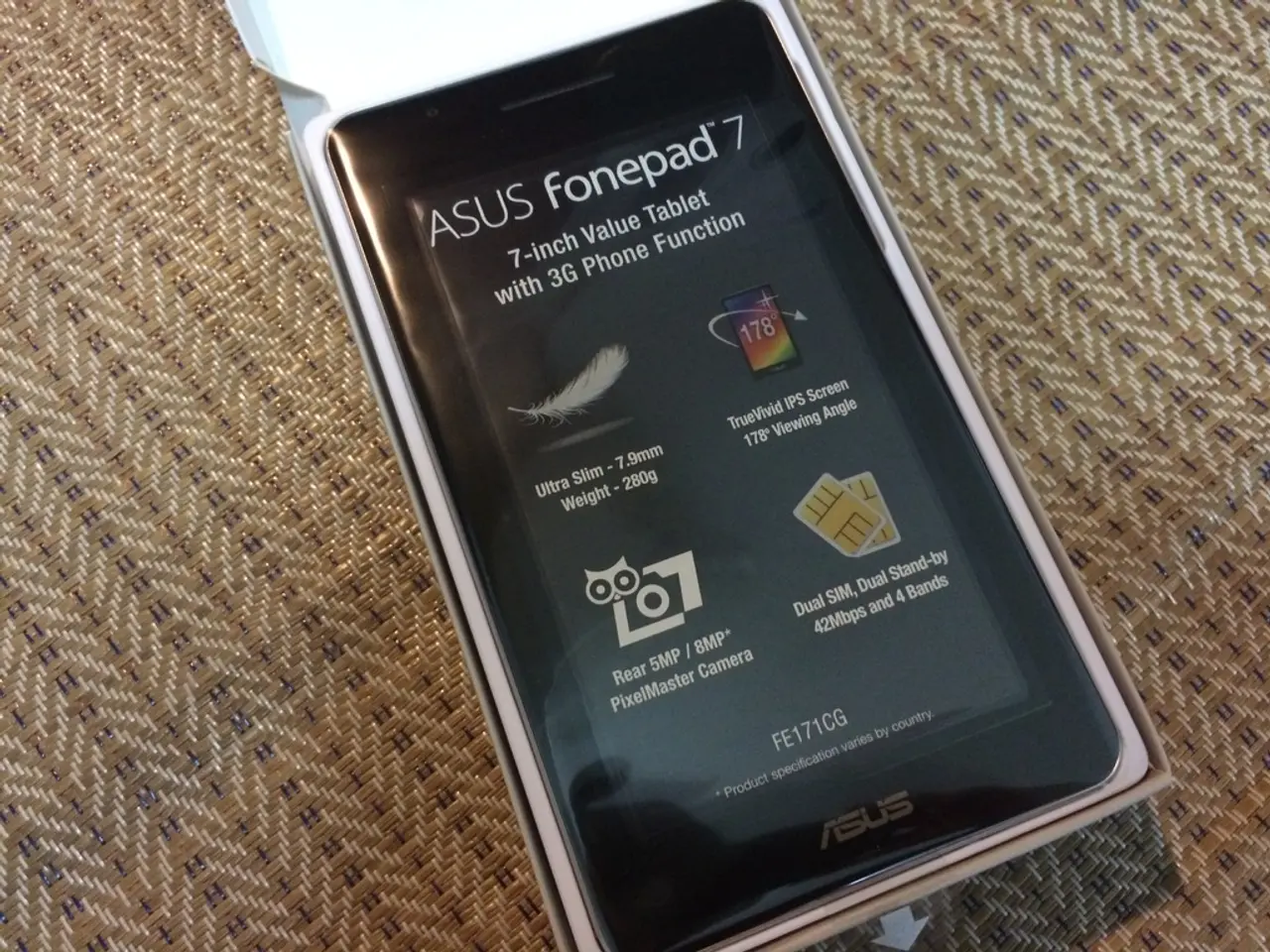

Despite these uncertainties, M-KOPA's approach to smartphone sales and financial services presents a compelling model for others aiming for a blend of hardware and credit services. The company's current smartphone lineup includes the X20, M10, S34, and entry-level X2, with more models set to launch later this year. These devices are sold exclusively through M-KOPA's sales agent network and are deeply embedded within its ecosystem.

As M-KOPA continues to grow and innovate, it remains a key player in Africa's digital economy, delivering tools for financial inclusion that can change lives. Co-founder and CEO, Jesse Moore, sums it up best: "We're delivering tools for financial inclusion that can change lives."

The fintech industry is being reshaped by M-KOPA's innovative model in Africa, as they merge smartphone sales with digital financial services, aiming to address financial inclusion gaps through their Smart Money Platform. M-KOPA's smartphones, including models like the X20, M10, S34, and entry-level X2, are sold exclusively through their agent network, strengthening their ecosystem.

M-KOPA's fintech powerhouse, despite some uncertainties about profitability and device ownership, continues to grow at a rapid pace, disbursing over $2 billion in digital credit and showing signs of a financially viable business model. By 2025, they aim to exceed $500 million in annual revenue and have already created over 400 jobs with their local smartphone assembly plant in Nairobi.

Beyond their smartphone business, M-KOPA's approach to financial inclusion, offering micro-loans, health coverage, and device insurance, has the potential to serve as a blueprint for other African fintech companies. Africa's digital economy is shifting towards measurable impact, and M-KOPA's strategy could play a significant role in this transition.

The fusion of finance, technology, and hardware implemented by M-KOPA presents a compelling model for others looking to blend hardware and credit services. Their vision to transform smartphones into portable financial hubs could lead to a new standard in Africa's fintech landscape, delivering tools for financial inclusion that can change lives.