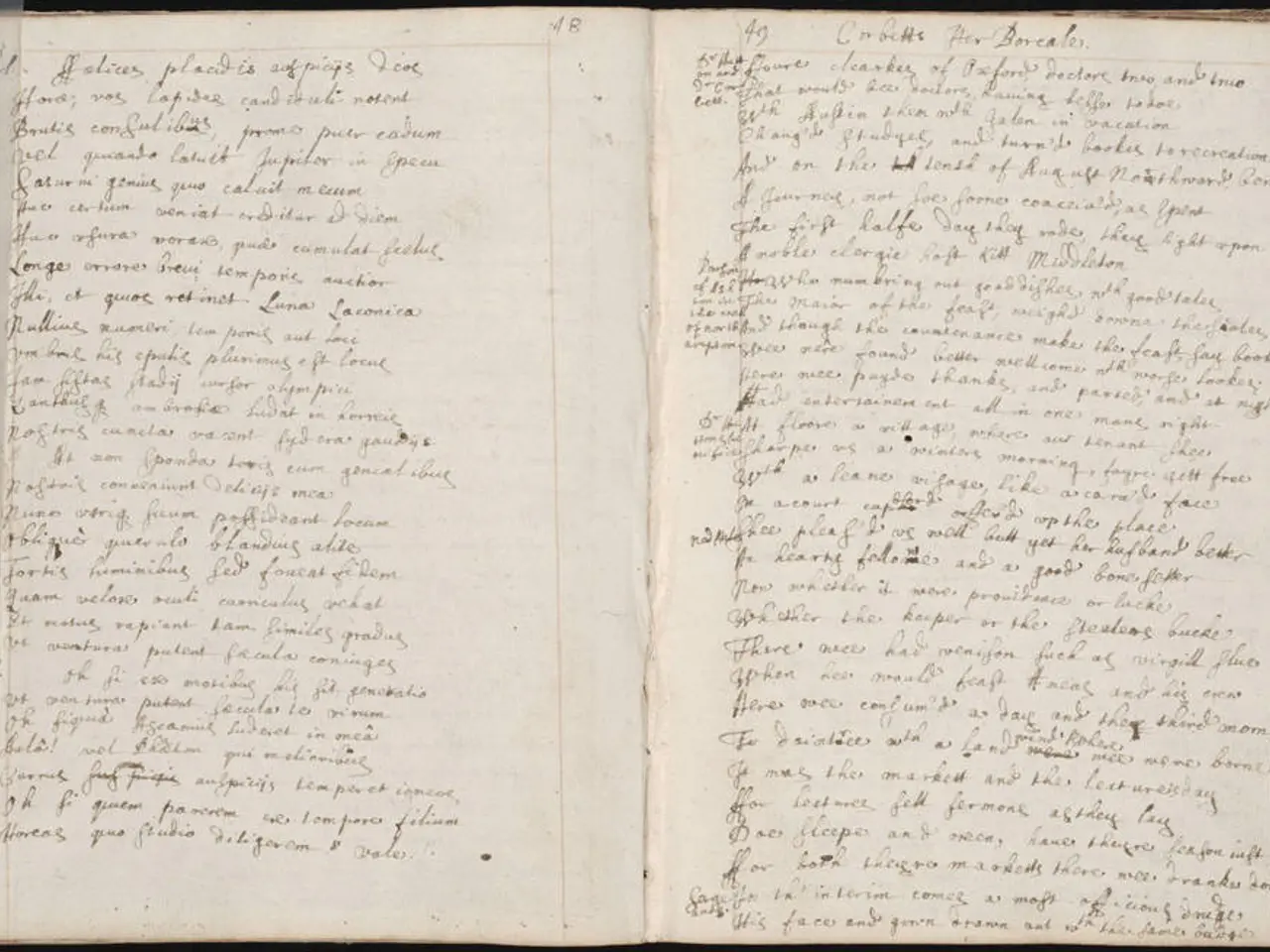

Rohit Chopra, a previous head of the Consumer Financial Protection Bureau, will appear as a speaker at OBExpo Canada 2025.

Rohit Chopra, the former director of the Consumer Financial Protection Bureau (CFPB) in the United States, will be a keynote speaker at the Open Banking Expo Canada on June 17. The event, which will take place at the MTCC in Toronto, aims to explore harmonizing Canadian standards with the US and the future of financial inclusion.

During his tenure at the CFPB, Chopra finalized an ambitious open banking rule (Section 1033) in October 2024. This rule aimed to give consumers more control over their financial data by requiring banks to share customer data with authorized third parties. However, the rule faces significant opposition from banks and some fintech advocates, who argue that it centralizes government control over data sharing and imposes rigid mandates without sufficient security guarantees.

The legal battle is intensifying, with lawsuits filed by the Bank Policy Institute and others against the CFPB’s rule. Courts have blocked some legal briefs supporting the CFPB rule but have also allowed fintech groups to intervene in defense of it. The Biden administration expresses a desire for consumers to control their data and for innovation to flourish, possibly through a revised or hybrid model of open banking rather than a strict continuation of the initial rule.

Chopra's keynote at the Open Banking Expo Canada will likely emphasize his vision of consumer financial data rights, regulatory balance for innovation, and the ongoing efforts to shape US open banking policy despite legal and industry challenges. He may also discuss where the US is falling short in Open Banking and what needs to happen for it to become a reality.

Chopra's work at the CFPB also aimed to preserve relationship banking and open up opportunities for new businesses through technology. In his letter to President Donald Trump, Chopra expressed pride in the CFPB's efforts to restore the rule of law.

The future of the US's Open Banking rule remains uncertain, with ongoing legal disputes and concerns about the rule’s practical effects. Modifications to the 1033 rule and ongoing stakeholder engagement are likely before a stable framework emerges.

The Open Banking Expo Canada will provide an opportunity for industry leaders, policymakers, and fintech advocates to discuss the future of open banking and financial inclusion in both the US and Canada.

Summary table of key points

| Aspect | Current Status / Outlook | |---------------------------------|-------------------------------------------------------------| | Chopra’s 1033 Rule | Finalized Oct 2024; mandates banks share consumer data | | Opposition | Banks, some fintech groups criticize for overregulation, security risks | | Legal Battles | Ongoing lawsuits, some court interventions blocking/supporting briefs | | Administration stance | Pro-consumer and innovation but open to rule modifications | | Market context | Market-driven voluntary APIs exist but CFPB mandates aim for uniform standards | | Upcoming keynote (Canada Expo) | Expected to highlight consumer data rights and US policy evolution | | Chopra’s keynote title | 'Unfinished Business: The next chapter for Open Banking policy in the US' | | Event details | June 17 at the MTCC in Toronto | | Chopra's conversation | Scheduled for 12pm on the Main Stage during Open Banking Expo Canada |

- Rohit Chopra's keynote speech at the Open Banking Expo Canada on June 17 will focus on the next chapter for Open Banking policy in the US.

- Chopra, as the former director of the Consumer Financial Protection Bureau (CFPB), finalized the 1033 rule in October 2024, which mandates banks to share consumer data with authorized third parties.

- The 1033 rule faces opposition from banks and some fintech advocates, who argue that it centralizes government control over data sharing and imposes rigid mandates without sufficient security guarantees.

- Ongoing legal battles and court interventions have been witnessed regarding the CFPB’s rule, with the Biden administration expressing a desire for consumers to control their data and for innovation to flourish.

- The Open Banking Expo Canada will bring together industry leaders, policymakers, and fintech advocates to discuss the future of open banking and financial inclusion in both the US and Canada.