Significant Increase in Realized Profits for Bitcoin as Price Reaches $111K: Recent Data by Glassnode

Going Cryptocurrency Crazy? Bitcoin Profit-Taking Galore

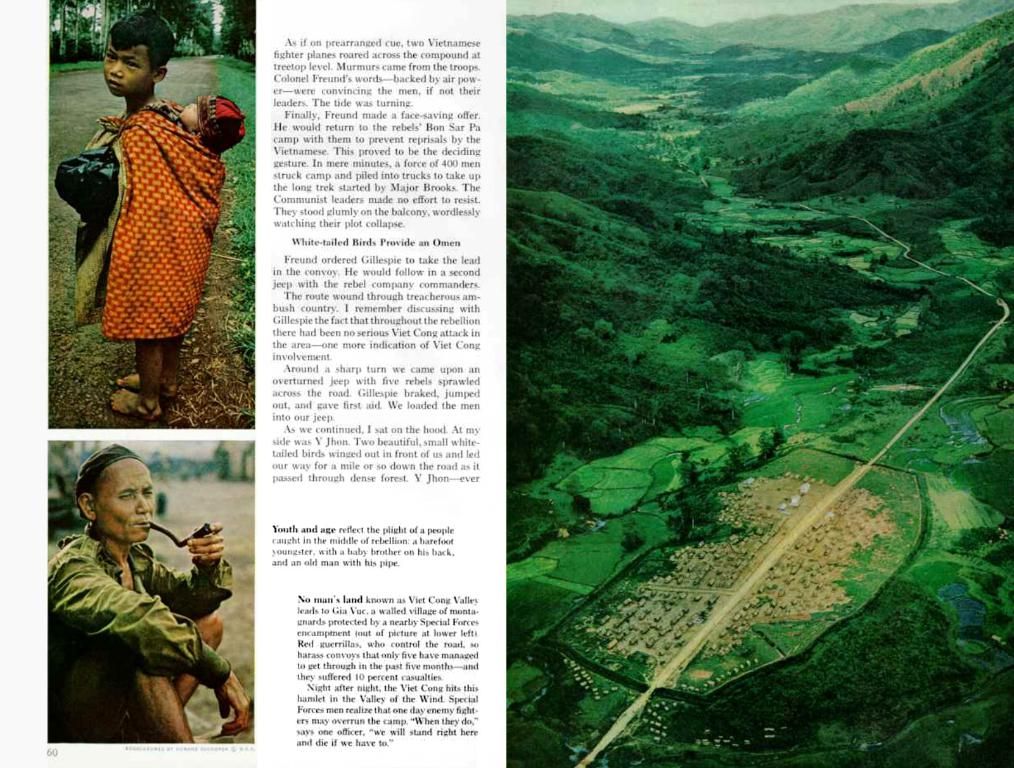

listeners, it's been a whirlwind ride for Bitcoin investors lately! With the digital coin charging up to a gleaming new all-time high (ATH) above $111,000, these folks have been cashing in big time. But wait, don't get too excited, because the currency has taken a breather since, consistently hovering around $105,000. Nevertheless, those huge stacks of Bitcoin are being emptied, fast.

Want proof? Check out Glassnode's Entity-Adjusted Spent Output Profit Ratio, which tells us that investors are raking in profits on less than 8% of trading days. Big money moves, right there!

Profit Extravaganza in BTC Town

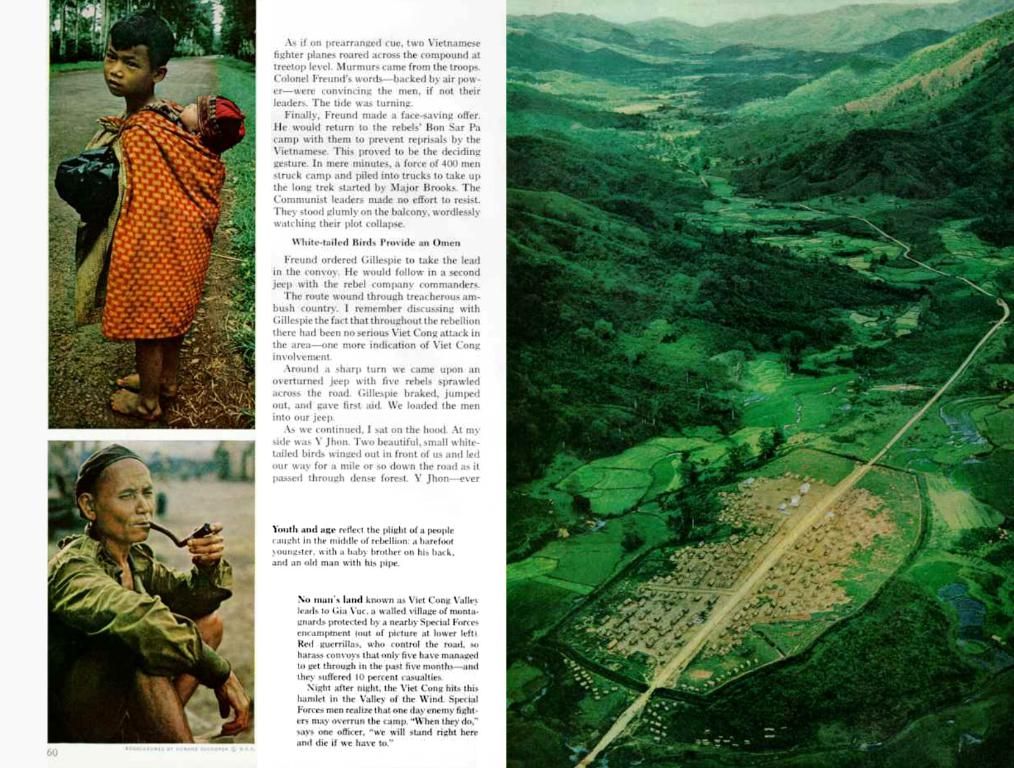

So what's the deal? Market intelligence firm Glassnode points a finger at profit-taking activity as the driving force behind Bitcoin's recent moves. Since the ATH explosion, the average Bitcoin has bagged at least 16% profit, and that's no small potatoes!

In fact, on May 3, Glassnode proudly noted a massive surge in their Entity-Adjusted Realized Profit. This metric soared above the $500 million/hour range not once, but three times within a single day, indicating a wild, highly profitable selling spree. And just to clarify, this profit-taking coincided with Bitcoin's brief recovery to $106,780.

So, here's the current situation. Bitcoin has retreated from the $105,000 zone it bravely attempted to conquer, and it's now fighting to stay above $105,500 as we speak.

Not Just Newbies, Long-Term Holders Are Selling Too

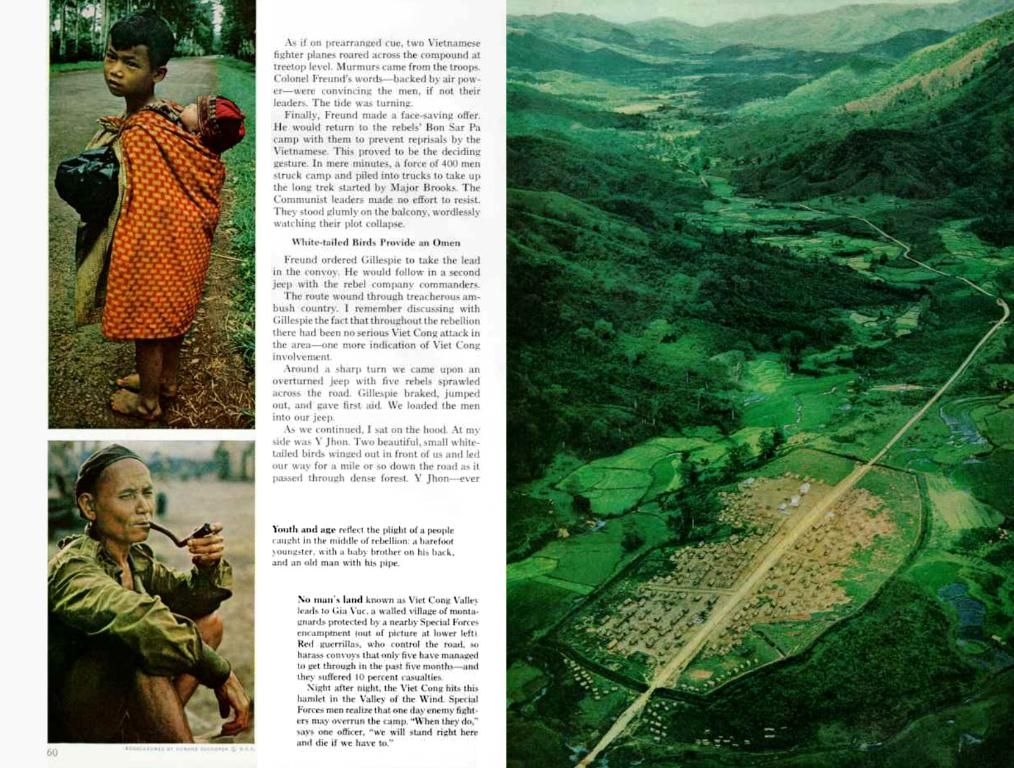

Last week, you may remember that Glassnode brought attention to long-term Bitcoin holders. Turns out, these old-timers weren't feeling left out of all the profit-taking fun. Holders who've locked up their BTC for anything from one to five years chipped in to haul in some serious loot. The collective volume they pushed surpassed $4.02 billion—the highest amount since February.

At first, there was some uncertainty about what motivated these sales, whether it was strategic reallocation or tucking money into the cookie jar. But now it's clear that even seasoned investors with Bitcoin aged between three to five years have been getting rid of their profits.

While the current profit-taking craze is in full swing, on-chain data suggests that long-term investors, particularly the three- to five-year cohort, might be tapped out when it comes to shedding coins. This group has locked in significant profits each time Bitcoin experienced its dramatic rally in March, October 2024, November 2024, and February 2025.

Currently, these veterans hold around 12% of the Bitcoin market's total wealth, meaning they've got a substantial chunk of those coins if Bitcoin decides to mount another charge. So if Bitcoin's marching ahead once again, keep an eye on those three- to five-year-old coins. Chances are their owners are ready to cash in again!

Is Your Bitcoin Wallet Calling Your Name? Binance Has a Welcome Offer for Our Readers! Want a bite of that Bitcoin pie? Here's your chance! Click here to open a new account on award-winning cryptocurrency exchange Binance and get $600, exclusively for our readers! Don't miss out on this exclusive offer!

But Wait, There's More! New to trading? Fancy raking in some free Bitcoin on Bybit? Click here to register and open a $500 FREE position on your favorite coin! Claim this offer now!

Bitcoin (BTC) Price Facebook Twitter LinkedIn Telegram

The profit-taking frenzy within the Bitcoin market has led to a surge in profits for many investors, as evident by the Entity-Adjusted Spent Output Profit Ratio showing profits being recorded on less than 8% of trading days.

Not only are new investors reaping benefits, but long-term Bitcoin holders, ranging from those who have held their BTC for one to five years, have also cashed in significant profits, with a collective volume exceeding $4.02 billion in the past week alone.