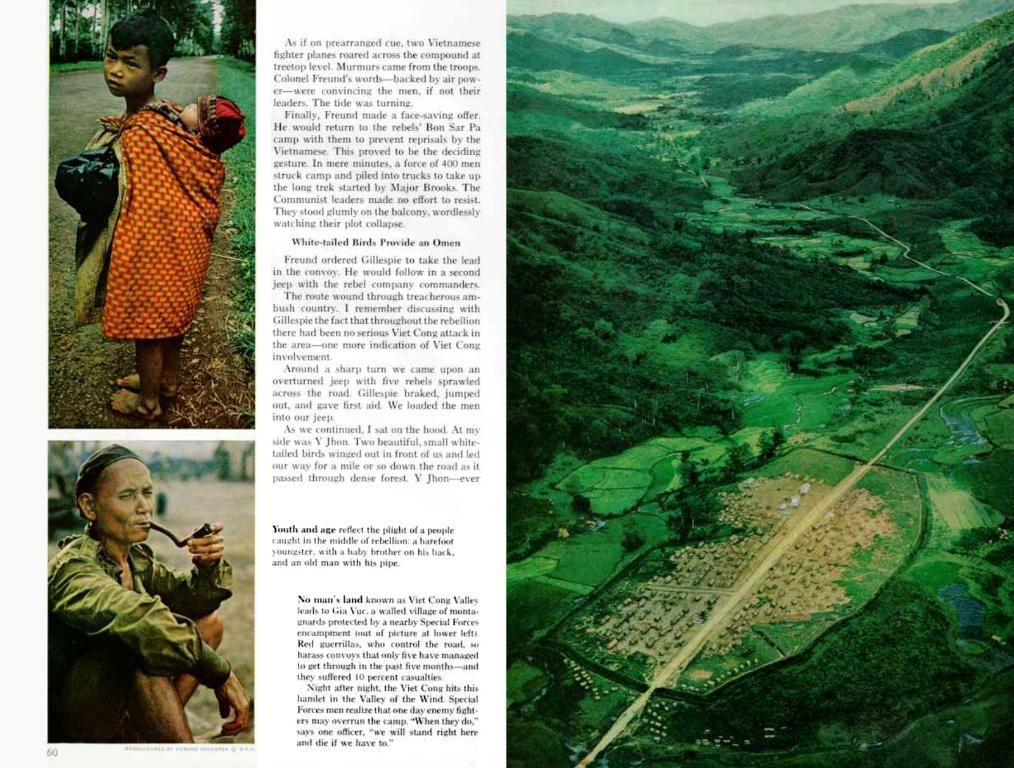

Top Tech Investor Declares the Magic of the Magnificent Seven as 'Extinct'

Takeover of the Tech Titans?

For ages, the mighty Tech Titans – colloquially known as the Magnificent Seven – have ruled the investment world, promising huge returns. Yet, one of its biggest profit-makers has recently declared this wealth-generating strategy obsolete.

Over the last decade, this small group of tech giants has seen a staggering tripling of their weight in the S&P 500, accounting for a whopping third of the index as of now. They soared an average of 63 percent in 2024 and contributed more than half of the index's total returns.

But the era of the Tech Titans' supremacy might be nearing its end. Stephen Yiu, a popular advocate for the tech stocks revolutionizing his fund's profits, has prophesied the end of their dominance.

"It doesn't mean they'll vanish," Yiu told City AM. "However, to outperform the markets like they did in the last five to ten years, I'd say that time has probably passed."

Since the dawn of 2025, these tech titans have struggled to match their former heights, with the Roundhill Magnificent Seven ETF, which ensures equal representation of all stocks, plummeting over 14 percent this year.

And if the Magnificent Seven begin to falter, Yiu foresees a drastic reduction in overall investment returns. "If the market was offering you more than 10 percent yearly, I think future returns might be around 5 percent. I'm making up numbers here, but they will be significantly lower."

According to Yiu, lingering high-interest rates post-pandemic have been a death blow to the once-thriving high-growth business model within tech since 2022.

"Unprofitable growth – where businesses capture market share recklessly, spending vast sums on marketing, products, and services – seems to be a thing of the past until interest rates drop again, which, currently, doesn't appear imminent," he says.

Yiu, the mastermind behind the £1.1bn Blue Whale Growth fund, once held shares in Microsoft and Meta but liquidated them earlier this year. He remains committed solely to Nvidia, a relationship that began in 2021 when the company was valued at $500 billion, now worth a staggering $2.8 trillion.

With the demand for Nvidia's AI infrastructure chips skyrocketing and significant investments in R&D, Yiu continues to back the "magnificent one." Although the Magnificent Seven have been dented by Trump's tariffs and are facing competition from Chinese AI firms like DeepSeek, Yiu only holds one UK-listed company – London Stock Exchange Group – in his portfolio, compared to approximately 15 American firms.

Yiu relies on a "high conviction portfolio" that focuses on unique companies with limited competition. "We have both Visa and Mastercard," he explains, "and there aren't other companies worldwide that are doing what they're doing. So, there isn't a competing alternative outside of America that I can buy."

Visa's stock has risen 11.2 percent since the start of 2025, while Mastercard has surged 7.7 percent, compared to a 4 percent decline in the S&P 500.

Yiu remains open to exploring investment opportunities beyond the US, such as Italian defense firm Leonardo, which has witnessed a staggering 70 percent increase in stock price since the start of 2025.

"Trump's policies have created a playing field for European defense companies," he says. However, aside from the defense sector, Yiu observes only a few appealing investment opportunities outside the US.

His latest acquisition for the Blue Whale portfolio is the US private credit giant Apollo, now a top-10 holding. According to Yiu, the private credit sector has experienced exponential growth as banks retreat from lending, leaving the sector with billions in 'dry powder' or committed capital, ready to be deployed.

As a lender reaping investment fees without assuming the risk traditionally associated with banking loans, Apollo represents an attractive investment opportunity for the fund manager.

- In the midst of technology's reign, Stephen Yiu, a notable finance advocate, has emphasized that the dominance of the Tech Titans in stock markets may have reached a plateau.

- Despite the Tech Titans comprising a significant portion of the S&P 500, with an average stock outperformance of 63 percent in 2024, Yiu meditates that this era of stellar returns might be fading.

- As the Roundhill Magnificent Seven ETF, representing these tech titans, has plummeted over 14 percent this year, Yiu predicts a reduction in overall investment returns if their dominance weakens.

- Leonardo, an Italian defense firm, has recently seen a 70 percent surge in stock price, signifying potential investment opportunities beyond the US that Yiu finds interesting.

- In the realm of financial investing, Yiu continues to back companies with unique qualities and limited competition, such as Nvidia, Visa, and Mastercard, despite the challenges faced by the Tech Titans and the prediction of lower future returns.

![Suspect Wanted for Bank Robbery: A notorious individual, identified as [Suspect's Name], is currently being sought by authorities for a brazen bank heist. The suspect, reportedly armed and dangerous, made off with an estimated sum of [amount of money]. Anyone with information regarding the suspect's whereabouts is urged to contact local authorities immediately. Major investors have found significant profits from the Magnificent Seven. However, one of its biggest gainers recently declared it to be largely defunct.](https://gizmoarena.top/en/img/20250506155645_pexels-search-image-description.jpeg)